All Accounts Feature

- Visa® debit card for easy shopping

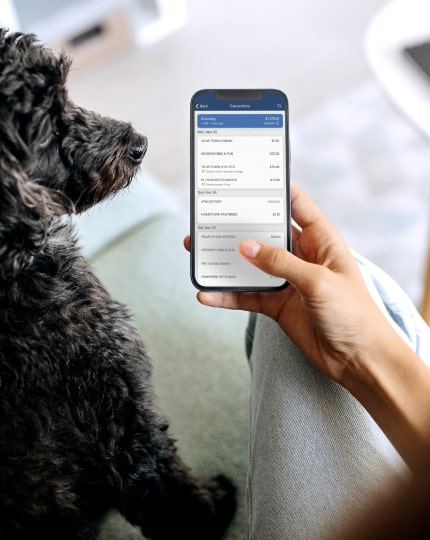

- Online and mobile banking

- Mobile check deposit

- Debit card account alerts*

- Optional Bill Pay

- Fraud monitoring

- Unlimited Hocking Valley Bank ATM usage

- Telephone banking

*Messaging or data rates may apply for debit card account alerts.

Three straightforward options to meet your needs.

Save time and money banking the way you choose to bank.

Pilot Account

An account with debit card access only

Select Account

An account with both check writing and debit card capabilities

Alliance Account

An account designed to grow with you and pay interest

Overdraft Protection Two Ways

Mistakes happen. We offer two options that can offer fast, easy solutions if you happen to overspend your checking balance.

Overdraft Reserve: You can arrange for an automatic transfer from another Hocking Valley Bank account to cover an overdraft. There is no charge for this service. You can transfer funds from any deposit account with the exception of CDs and IRAs.

Cash on Demand: You obtain a line of credit, which then supplies the funds needed to avoid an overdraft situation. An application and credit report are required. One of our banking specialists can help you decide on an appropriate line of credit amount. For details about the service, including fees and payment information, please view our COD Account Agreement.

Mobile Banking

Your account goes where you go.

Easily and securely manage your Hocking Valley Bank deposit and loan accounts anytime, anywhere.